Finance & Banking

Banks Use Digital Signage to Communicate, Promote, and Enhance Customer Experiences

Identify the needs and pitfalls

In banking, many banks are using digital signs to make customers happier, work better, and stay competitive. To do this well, it’s important to know what digital signs can do and what problems might happen.

Sometimes, using digital signs in banks can be hard. If the signs show different things in different branches, customers might get confused. Also, if the information on the signs is old or not useful, that’s a problem. We need to make sure the signs always show the right stuff.

Navori’s software is like a helpful friend for banks using digital signs. It makes sure the signs show the same things everywhere, so customers aren’t confused. It’s easy to change the information on the signs to keep it fresh. Navori also makes sure that the information is safe and follows the rules. They even help take care of the signs, so they keep working well. With Navori’s software, banks can use digital signs without worrying too much and make customers happy.

Why banks use informational digital displays?

Free-Up Tellers with Answers to Basic FAQs

Empower your customers with self-service options. Digital Signage screens can efficiently provide answers to frequently asked questions, reducing the burden on tellers and ensuring a smoother customer flow.

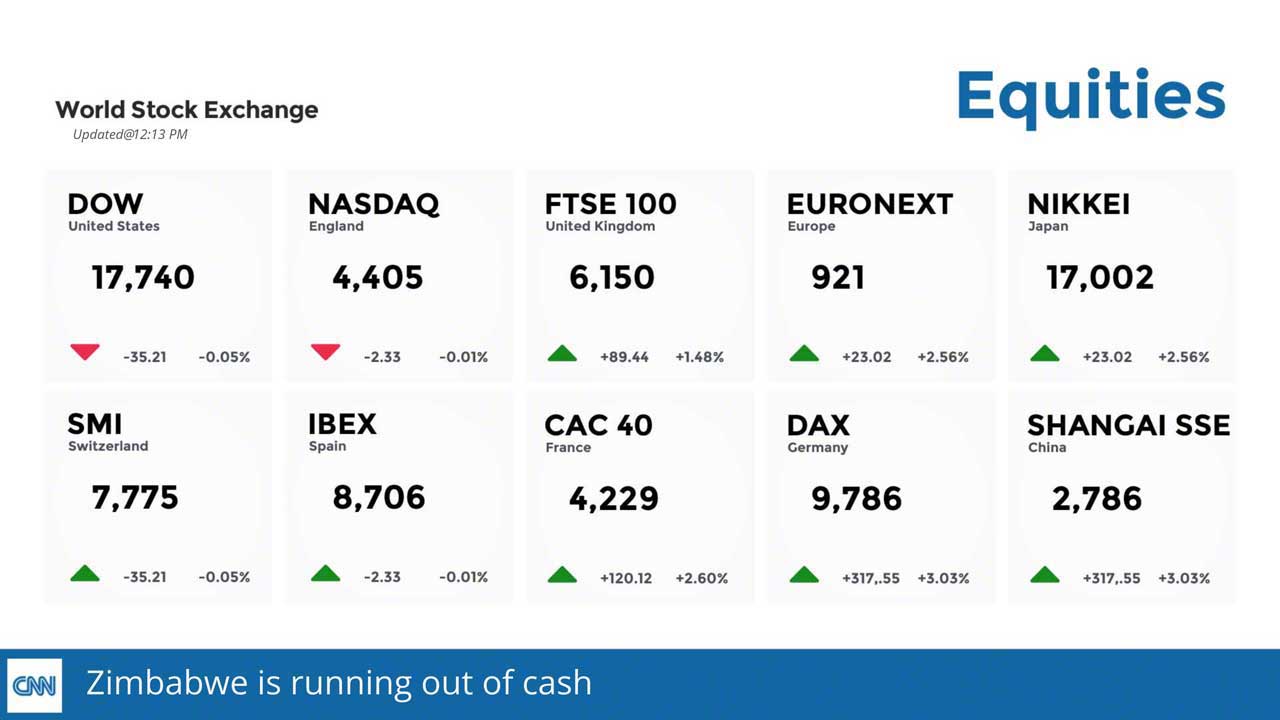

Display Real-Time Data with Ease

Effortlessly showcase real-time data such as stock prices, exchange rates, and more. Digital Signage screens provide a dynamic platform for displaying critical financial information in an easily digestible format.

Offer a consolidated view of critical information shortening the response time

Navori’s digital signage software excels in aggregating data from multiple sources into a unified dashboard. This consolidated view of critical information streamlines the decision-making process, significantly reducing the response time to changes in the business environment.

Reduce perceived wait times of customers waiting for service

Navori Digital Signage actively reduces perceived wait times for customers by presenting captivating content and informative displays. These elements distract and entertain, effectively shortening the perceived duration of the wait, contributing to an overall improved customer experience.

Enhance the Visual Appeal of Your Branch

Aesthetics matter. Digital Signage content displayed on screens offer an opportunity to create an inviting atmosphere, fostering a positive perception of your branch. Dynamic visuals and interactive displays elevate the overall look and feel.

Real-life Use Cases

Display Real-Time Stock Prices, Exchange Rates, and More

Navori Digital Signage Software empowers financial institutions to broadcast up-to-the-minute financial data, keeping customers informed and engaged.

Manage Screens in Every Branch from a Single Platform

Navori’s centralized platform enables effortless management of screens across multiple branches, providing consistency and control from a single point.

Keep Customers Informed of Which Services Are Currently Available

Ensure customers are well-informed about the services currently available at each branch, reducing confusion and streamlining their banking experience.

Seamlessly Manage Your Teller Queues

The QL platform allows for the efficient management of teller queues, reducing wait times and improving overall customer satisfaction.

Mix in Infotainment and Live Social Media Content

Enhance the customer experience by combining financial information with infotainment and live social media content, creating a dynamic and immersive environment.

In Conclusion

Navori’s Digital Signage Solution, QL, is a vital tool for institutions aiming to stay competitive. Navori understands the unique needs of the industry and provides flexible solutions, empowering financial institutions to improve customer experiences, streamline operations, and stay at the forefront of technology.

Enhance your banking environment with Navori’s QL Digital Signage Solution, where transformation and efficiency come together to prepare you for the future of finance.